My Fortune 2 in 1

My Fortune 2 in 1 is your personal financial advisor utility which helps to manage your mortgage and retirement plan. You may play the calculations by changing parameters. Giving any 4 of 5 factors to get the rest 1 answer. As well as modifying 1 parameter, clicking another 1 to know the changes.

3 major functions are:

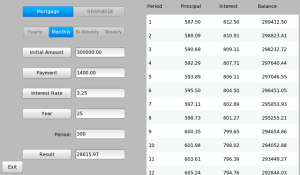

1 In Mortgage page, 5 factors are included as payment, initial principal, interest rate, years of amortization and end balance. When keying in the principal you would borrow, the interest rate committed, and the year of total amortization, then putting 0 in the end balance to make it paid off – A period payment supposed to be shows up in payment spot. You may choose yearly, monthly, bi-weekly or weekly plan to go. Typically to convert from monthly payment plan to biweekly will save you at least 15% of time to pay off your mortgage.

2 The similar concept is in the RRSP/401K page. That name represents US/Canadian pension plan. However you can use the tool to calculate any investment portfolio returns not limited to those two counties or pension plans. It contains 5 parameters too – payment, initial amount, interest rate, number of investment years and the end balance. Usually people would have a goad of retirement, lets say 1 million dollars. With the expected return such as 6% as conservative or 12% as aggressive investment, in any number of years from now to your retirement age, to know how much you need to set aside every year, month or week is very helpful. If you feel you can save a fixed amount every month, put this number in payment then clicking years or periods, it will let you know how many years takes you to reach your goal. You might be glad to know that with a good plan, you can retire younger or richer than you thought.

3 Theres another way to use RRSP/401k page which also regarding pension management. It refers the situation that youre ready to retire. For example, you have half million in your pension or similar account, and you would start to enjoy the happy retirement. Then putting down the initial amount as half million; an average investment return as 6% or anything realistic or you feel comfortable; the years you think youll need this pension; and leaving 0 for running out the money – clicking the payment spot, youll see a negative number. That is the monthlyor yearly/weekly resource you can spend in your future life. Playing this calculations schedule based on your updated investment returns; total money left; or the year changes, you are able to have a secure control to spend your pension wisely.

Have fun to play the calculations. We wish you a healthy and wealthy wonderful life!

App Name:My Fortune 2 in 1

App Version:1.1.0

App Size:221 KB

Cost:US$1.99 USD